BLOG

Affordable upstate

How Offering Flexible Payment Plans Can Boost Affordable Housing & Economic Mobility

By: Mario Brown, Jan. 13, 2025

A staggering 48% of renters in the United States are classified as "cost-burdened," spending over 30% of their income on housing. The rising cost of living, combined with income instability, has forced many renters into financial difficulties that make conventional rent payment structures unsustainable. This financial stress often leads to high eviction rates, poor credit scores, and significant barriers to upward economic mobility for renters, particularly those in affordable housing.

Flexible rent payment systems offer a promising solution by aligning payment schedules with residents' income patterns. This article explores their role in reducing eviction rates and improving economic stability, drawing on data from Noah's innovative Flex Pay program.

HOW FLEXIBLE PAYMENT SYSTEMS WORK

Flexible payment plans are designed to accommodate renters' financial situations, allowing them to pay in smaller, manageable increments rather than a lump sum at the start of the month. These systems often leverage technology to simplify payment scheduling and offer options such as:

- Split Payments: Renters can divide their payment across multiple paydays.

- Customized Due Dates: Payment schedules align with renters’ biweekly or weekly income cycles.

- Automatic Withdrawals: Payments are deducted directly from bank accounts to ensure timeliness.

Programs like Noah's Flex Pay take these innovations one step further by integrating advanced tech solutions that offer landlords predictability while minimizing financial strain for tenants.

The Problem with Traditional Rent Structures

Traditional rental agreements require tenants to pay rent in full by the first of the month, a rigid system that often clashes with renters' earning patterns. According to data by the Zillow Group, nearly 50% of renters are paid weekly or biweekly rather than monthly, creating a timing mismatch. Other challenges exacerbating financial stress include:

- Income Volatility: Especially prevalent among gig workers and freelancers, with unpredictable earnings impacting payment capacity.

- Rising Cost of Living: Rent prices in urban areas show year-over-year increases of 10% or more, outpacing wage growth.

- Unexpected Expenses: Emergencies like medical bills or car repairs frequently leave renters short on funds.

The consequences are stark. Renters unable to meet payment deadlines face late fees, poor credit scores, tenuous landlord-tenant relationships, and, ultimately, eviction.

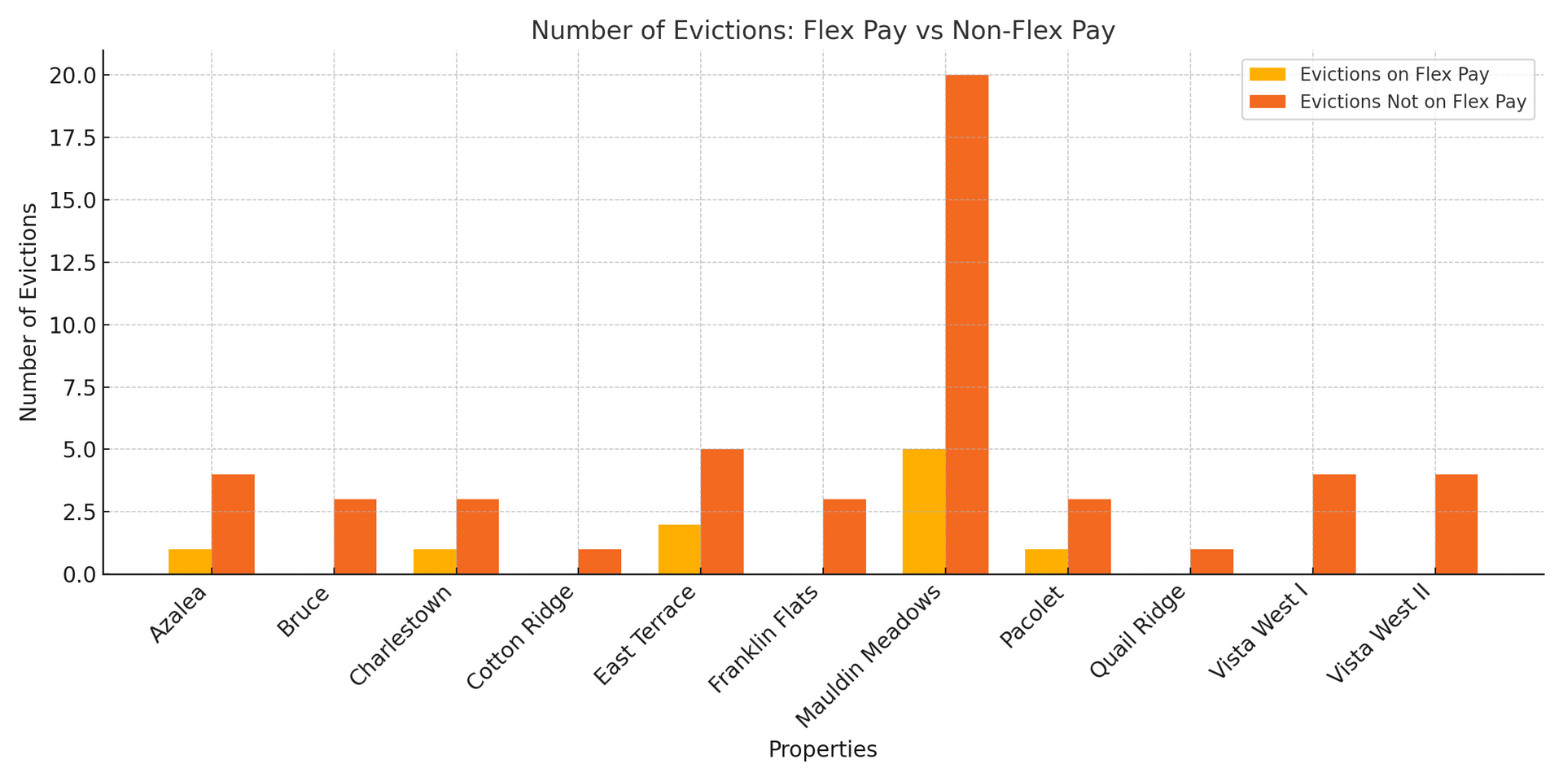

Statistical Snapshot from Noah's Flex Pay

Data from Noah’s properties highlights the impact of these challenges:

- Eviction Rates for Non-Flex Participants averaged between 12-20% across various locations.

- Eviction Rates for Flex Participants, on the other hand, dropped significantly to zero in multiple properties including Quail Ridge and Vista West.

This evidence underscores the advantages that flexible payment systems can provide to struggling renters.

The Impact of Flexible Payment Plans on Economic Mobility

1. Reduced Eviction Rates

Flexible payment systems, such as those implemented through Noah’s Flex Pay, directly address the root causes of eviction. For instance, Azalea Apartments, which reported a 12.12% eviction rate for non-Flex participants, saw eviction rates halved among Flex participants. With such systems, tenants are less likely to default entirely on rent payments, managing their obligations in smaller, more achievable increments.

2. Improved Credit Health

By avoiding eviction and late fees, renters can protect their credit ratings. Programs like Noah's Flex Pay allow tenants to maintain payment discipline, ensuring timely rent payment without resorting to high-interest payday loans. Improved credit health expands renters' financial opportunities, from qualifying for future housing to accessing affordable loans.

3. Financial Stability and Mobility

Aligning rent payment schedules with wage cycles reduces cash flow mismatches, giving renters more room to manage other expenses like healthcare or education. The ability to stay housed securely supports tenants in focusing on long-term goals such as upskillling, saving, or transitioning to higher-income opportunities, fostering broader economic mobility.

4. Strengthened Tenant-Landlord Relationships

Tenants facing financial hardship are more likely to engage collaboratively with landlords who offer flexibility. Noah's data also shows that landlords incorporating Flex Pay see fewer turnover costs, improved tenant satisfaction, and fewer disputes—strengthening the landlord-tenant bond.

Challenges and Considerations

While flexible payment systems present many benefits, they are not without challenges:

- Added Fees and Costs

Third-party platforms like Flex or Domuso typically charge tenants additional fees for the convenience of flexible payments. Noah's implementation minimizes these costs by offering in-house Flex Pay options supported by landlords.

- Systemic Economic Constraints

Flexible payments are not a solution to systemic issues such as stagnant wages or inadequate supply of affordable housing. They are a valuable tool but require complementary policy measures, including rent control and wage growth initiatives.

- Limited Adoption

Small-scale landlords often lack the financial bandwidth or technical resources to implement flexible payment systems. Expanding access requires broader industry adoption backed by government incentives.

Real-Life Applications and Success Stories

1. Azalea and Mauldin Meadows (Noah Properties)

Residents at these properties reported significant reductions in eviction rates due to Flex Pay. At Mauldin Meadows, eviction rates for Flex participants were slashed to 12.82%, compared to 16.80% for non-Flex users.

2. The Irvine Company

A California-based property management company rolled out flexible rent payment systems across their portfolio, resulting in a 20% decrease in late payments and turnover rates—a key indicator of tenant satisfaction.

3. Related Companies

By offering Rent Café, tenants were allowed to auto-schedule payments tailored to their payday schedules. This initiative led to a 30% increase in on-time rent payments and enhanced landlord cash flow stability.

These examples showcase how tailored payment flexibility can yield tangible outcomes for both tenants and landlords.

A Vision for the Future of Housing Payments

The adoption of flexible rent payment systems isn’t just a technological upgrade—it’s an essential step in creating equitable and sustainable housing for all. By addressing renters' financial constraints, flexible payment plans reduce evictions, improve economic mobility, and foster a stronger sense of community among residents and landlords alike.

Noah’s Flex Pay data demonstrates how progressive payment solutions can transform lives. If you’re a housing developer, non-profit, or landlord interested in implementing these programs, reach out to our team for a consultation. Together, we can design better systems for economic stability and housing security.

Learn more about Flex Pay and how it can work in your housing development program. >Contact us today to get started!