BLOG

Affordable upstate

How Property Owners Can Reduce Evictions and Strengthen Communities

Evictions aren’t just a legal hassle or a line on a landlord’s spreadsheet—they’re a human crisis that ripples from one person to entire communities. At Affordable Upstate, we’ve seen the eviction problem up close. Managing over 1,500 naturally occurring affordable housing (NOAH) units across Greenville and Upstate South Carolina, we deal with evictions weekly. It’s not a challenge we can eliminate entirely, but as our CEO Mario Brown said on the

Simple Civics: Greenville County podcast, “We cannot solve the problems of evictions, but we can impact it.”

In 2024, we’ve proven it—slashing eviction filings with practical solutions that property owners like you can use too. Here’s how the eviction crisis unfolds—and how we’re fighting back.

The Person: A Permanent Mark

Imagine you’re a renter in one of our communities. Life throws a curveball—maybe a temporary job loss, a medical emergency, or a car breakdown—and suddenly, you’re behind on rent.

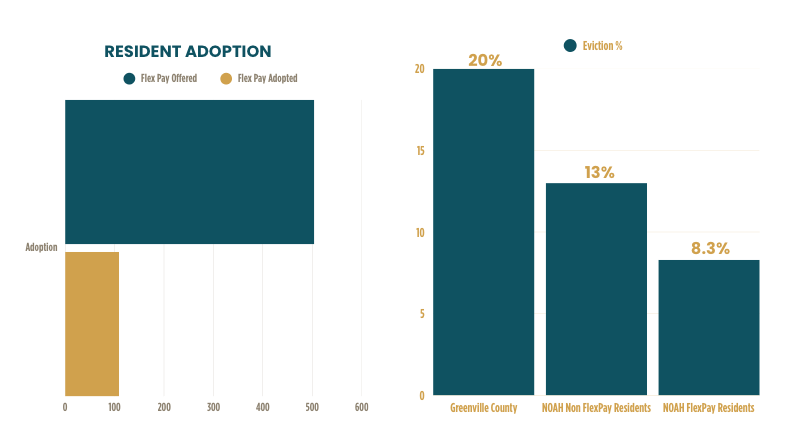

An eviction filing lands on your doorstep. Even if you scrape together the funds to resolve it, that filing sticks with you like a permanent tattoo. It’s a mark that can haunt you for years, making it harder to secure a new place to live. In Greenville County, where 20% of renters faced an eviction filing between March 2020 and August 2024, this isn’t a rare story—it’s a common one.

The impact is immediate and profound. Kids might have to switch schools mid-year, disrupting their education. Stress piles up, affecting mental and physical health. For some, it’s a direct path to homelessness. This isn’t just a statistic; it’s a neighbor, a barista who pours your morning coffee, or a teacher shaping your child’s future. The personal toll is steep, and it’s where the eviction crisis begins.

The Community: A Shared Burden

Zoom out a bit, and you see how one eviction ripples through a community. When families are uprooted, neighborhoods lose stability. Schools see higher turnover, small businesses feel the pinch as service workers struggle to stay local, and the fabric of a place like Greenville starts to fray. Mario put it perfectly on the podcast:

“If we care about our service workers and our baristas, we care about our children’s teachers, the folks that actually need to access attainable housing, we should care about this issue because this impacts them.”

The economic fallout is real too. When housing costs spike due to instability, that $3 latte becomes $3.50. It’s not just about compassion—it’s about the sustainability of the vibrant Upstate community we all love. Evictions don’t just displace people; they strain the very ecosystem that keeps our region thriving.

The City, State, and Beyond: A Systemic Challenge

Step back even further, and the picture gets bigger. Greenville County’s eviction filing rate hovers around 22%—nearly three times the national average of 8%. South Carolina as a whole struggles with some of the highest eviction rates in the country. This isn’t just a local quirk; it’s a systemic issue tied to inconsistent processes, economic pressures, and a lack of affordable housing options. The variability in how evictions are handled—depending on the county, the magistrate, or even the day of the week—only deepens the problem. It’s a mess that costs cities and states in lost productivity, increased homelessness, and overburdened social services.

Nationally, experts like Matthew Desmond have pointed out that evictions are a

cause of poverty, not just a symptom. When one in five renters in a place like Greenville faces this threat, it’s a signal that the system isn’t working—for anyone.

The Property Owner: Caught in the Middle

Now, let’s bring it home—the property owners. At Affordable Upstate, we’re not just observers; we’re in the thick of it. Evictions cost us too, and not just emotionally. Mario shared on the podcast that each eviction process runs between $3,000 and $5,000—about 18% of our operational leakage. That’s lost rent, attorney fees, and the downtime of turning over a unit. It’s a hit we feel every time, and it’s one we’d rather avoid.

But here’s the kicker: those costs don’t just disappear. They get passed on. A unit that could’ve rented for $1,000 might now need to be $1,050 or $1,100 to offset the loss. That’s the harsh reality of multifamily ownership—sustainability demands revenue, and evictions chip away at it. For us, it’s not about wanting to evict; it’s about needing to keep the lights on, pay our own mortgages, and maintain quality housing for the majority of residents who do pay on time.

What Property Owners Can Do

How We’re Making an Impact

At Affordable Upstate, we’re not here to pretend evictions can be wiped out entirely—non-payment happens, and we’ve got to keep our properties sustainable. But we

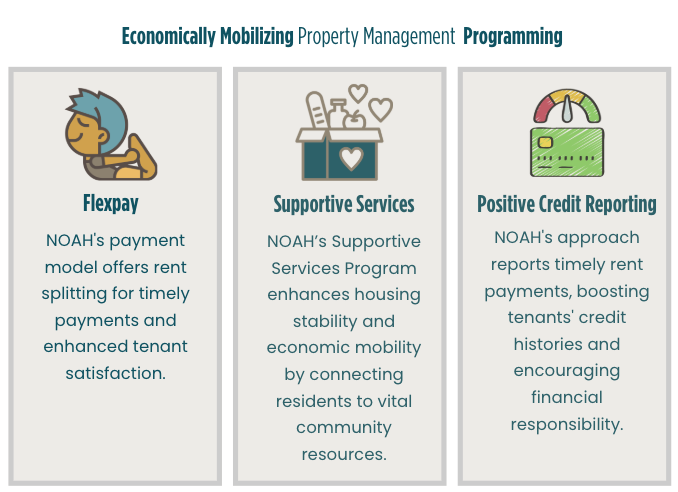

can shrink the numbers, and in 2024, we’ve done just that. Partnering with NOAH Property Management, we’ve rolled out strategies that have cut eviction filings across our 1,500+ units, saving families from displacement and keeping our bottom line healthier. Here’s how we’re doing it—and how you can too:

#1 - Flex Pay Program: Payments That Fit Real Life

Rent’s due on the 1st, but paychecks don’t always line up. That’s why we launched Flex Pay, letting residents choose to split their rent into weekly or bi-monthly payments upfront. It’s not a reactive fix—it’s a proactive option they can sign up for from day one. In 2024, NOAH’s impact report showed that residents enrolled in Flex Pay had a 33% lower eviction rate than those on standard monthly schedules. Why? Because smaller, regular payments match how most people actually earn—week by week, not month by month.

How to Implement It: Start by surveying your residents—ask how they’d prefer to pay. Set up a simple system (we use property management software to automate it) where they can opt in at lease signing. Offer two or four payments per month, and stick to a firm schedule. It’s not about leniency after the fact; it’s about building flexibility into the structure. The result? Fewer missed payments, fewer filings, and happier tenants.

#2 - Positive Payment Reporting: Turning Rent Into a Reward

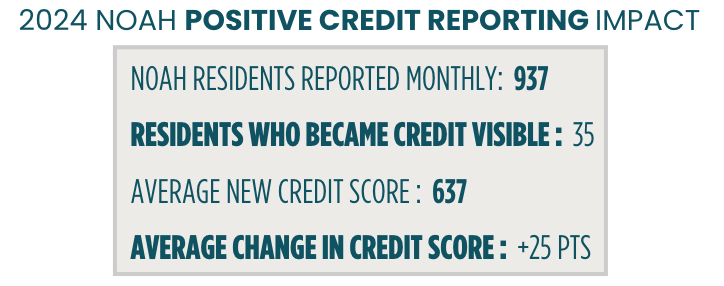

Renters pay on time, but their credit scores don’t budge—meanwhile, a single eviction filing can tank them. We flipped that script by reporting on-time rent payments to credit bureaus, giving residents a tangible boost for consistency. In 2024, this move correlated with a double-digit drop in late payments across our portfolio—fewer of which escalated to evictions. It’s a win-win: residents build financial stability, and we get steadier cash flow.

How to Implement It: Partner with a service like Rent Dynamics or LevelCredit (we use a similar platform) to report payments to Equifax, Experian, and TransUnion. It’s a small upfront cost—usually a few bucks per unit—but the payoff is huge. Promote it to your residents as a perk, and watch engagement climb. Pro tip: Make it opt-in to keep it simple, and highlight the credit-building angle in your marketing.

#3 - Proactive Communication: Catching Problems Early

Evictions don’t start with a filing—they start with a missed payment. Our team at NOAH doesn’t wait for that to spiral. We reach out within days of a late payment, offering flexible terms (like a short-term payment plan) or connecting residents to local resources—think rental assistance programs or nonprofits we’ve vetted. In 2024, this approach kept hundreds of families in their homes, reducing our eviction filings by a measurable chunk compared to prior years. It’s not about coddling; it’s about catching the issue before it’s a crisis.

How to Implement It: Train your staff to act fast—set a policy to contact residents within 48 hours of a missed payment. Build a cheat sheet of local aid options. Offer a one-time payment plan—say, splitting the overdue amount over two months—but tie it to a signed agreement. It’s low-cost, high-impact, and keeps units occupied instead of vacant.

These aren’t pie-in-the-sky ideas—they’re tested, data-backed moves that made 2024 a turning point for us. NOAH’s impact report shows we’ve slashed eviction filings year-over-year, not by avoiding tough calls, but by giving residents tools to succeed and ourselves a buffer against turnover costs. For us, that’s $3,000 to $5,000 saved per avoided eviction—money we’d rather reinvest into our properties than lose to legal fees and downtime.

Whether you manage 10 units or 1,000, the principles scale: align payments with reality, reward consistency, and intervene early. You’ll keep more residents housed, cut your own losses, and prove that multifamily ownership can be profitable

and purposeful. At Affordable Upstate, we’re living proof it works.

Make sure to check out the media below!

Diversify Your Portfolio with Commercial Real Estate Investments Opportunities

MORE FROM THE BLOG