BLOG

Affordable upstate

Financial Repression in the 2020s

This month our favorite read was

an interview (which we

highly

recommend you read) with

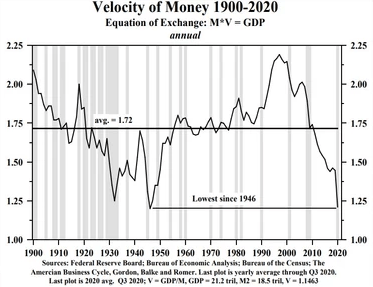

Russell Napier, perhaps the world’s top financial historian. For decades, Napier correctly forecasted disinflation as the dominant force in financial markets. He pointed to themes such as aging demographics, cost-saving technology, cheap Chinese exports, increasing debt burdens, and the decline of the velocity of money as key deflationary factors

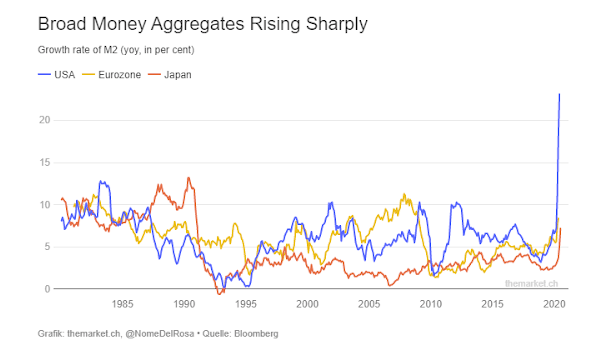

However, last summer Napier warned US investors should prepare for 4%+ annual inflation rates throughout the 2020s. Two key changes caused his pivot. The first was the rapid growth of the money supply despite the country being in the worst recession since World War II.

The second change was the US government in 2020 intervening in the commercial banking system by telling commercial banks to grant loans to companies. The US Treasury guaranteed loans such as PPP, completely circumventing central banks. As a result, politicians, not central bankers, now control the money supply, and they need inflation to get rid of high debt levels. Napier argued that now that politicians have the tools to create inflation, they will use them.

One Year Later

Now that one year has passed from Napier’s predictions, we find core CPI soaring to 5.4% as of July 13th, 2021.

Most importantly, Napier is now predicting that despite the rise of inflation, “Interest rates will not be allowed to reflect that rate of inflation. That is what changes the entire structure of finance...This is because we will be entering a period of financial repression, where governments keep interest rates below the rate of inflation, just like after World War II.”

For the last 40+ years, bond yields have accurately reflected the inflation outlook. Now they are no longer in a free market, depressed by central bank purchases and regulatory requirements for banks and insurance companies to hold them.

Napier predicts that central bank monetary policy will become increasingly irrelevant versus government fiscal policy. Central banks will jawbone as if they are in control, and it will work for some time because the market is so conditioned that the Fed is the dominant force.

In the short-to-medium term, equities and real estate prices should benefit as wealth will increasingly transfer from savers to debtors. After a few years, the government will cap bond yields, and only then will the masses wake up to the new inflationary paradigm.

Interest rate caps will lead to the misallocation of capital, which typically leads to high inflation and high unemployment, i.e., stagflation. And that’s when limited-supply assets like gold and bitcoin should outperform.

We find Napier’s views particularly compelling as we participate in the investing arena. Place your bets...

The information contained in this post is provided to you solely for informational purposes only, and is not to be shared, distributed, or otherwise used for any other purpose without direct reference to Affordable Upstate or link back to this post. This post is provided for education and discussion purposes only and does not constitute an offering. Opinions and projections included in this newsletter are provided as of the date of publication, may prove to be inaccurate, and are subject to change without notice. Prospective investors should not treat these materials as advice regarding legal, tax, or investment matters. No recommendations are made to invest in Affordable Upstate nor any other investment. An offering may be made only by delivery of a confidential offering memorandum to appropriate investors. Past performance is no guarantee of future results. Additional information about Affordable Upstate and its performance is available upon request.

Diversify Your Portfolio with Commercial Real Estate Investments Opportunities

MORE FROM THE BLOG