BLOG

Affordable upstate

Multifamily Operations Season, Spring 2023

Written by: Mario E. Brown

As market activity within commercial real estate slows to a crawl, value-eroding inflation has continued to rip, severely impacting multifamily owners' net operating income. Gone are the days of fast, double-digit rent premiums that, for a while, masked the impact of inflation on MF assets NOI. Now is the time for multifamily owners/operators/syndicators to think about operational efficiencies.

As owners of workforce and affordable housing, our business plans and underwriting have always been conservative around revenue growth, ensuring the future of asset-stabilized rents is affordable for those living at 60-80 AMI. Because we have decided to cap rental growth, we have always scrubbed potential property operations for other efficiencies and services that create yield for both our residents & investors. Our focus has continually been expanding and implementing specific services that positively improve the everyday lives of our residents (e.g., Wholesale Cable & Internet Packages, Rental Insurance, and Flexible Payment ) while offering significant investment returns to our investors. Supplementing our moderate base rent growth with tenant-centered services and alternative revenue streams that are not zero-sum creates tangible value for our residents and meaningful yield for our investors.

Spurred by the Fed's aggressive interest rate hikes over the last 15 months, the entire multifamily sector is in a new season. A season defined by inflation, increased operational expenses, and flat topline growth as tenants struggle to keep up with their household inflation. Our firm's unique value proposition has historically been our target demographic, improving and preserving their available housing stock through capital improvements & targeted services. Over the next 12 months, our value, like all multifamily operators, will be in our ability to lean into scaled solutions that allow us to reduce expenses and control costs while delivering higher quality service to our residents and, ultimately, our investors.

Here is where our team has spent its time over the past year preparing for the other side of the multifamily bull run we have all participated in:

1. Property Taxes

As a mission-driven for-profit, our commitment to preserving workforce housing is underpinned by our ability to layer the most efficient affordable housing incentives onto our Naturally Occurring Affordable Housing assets. To this end, in 2022, we partnered with the Southeast Affordable Housing Administration (S.A.H.A) to layer affordable housing property tax abatements across our portfolio. Since the inception of our partnership, S.A.H.A. has successfully abated over 2MM of Real Estate Property taxes within our portfolio. In addition, we've hired Anthony Thompson, our in-house counsel with extensive experience with large institutional real estate transactions and a heart for our mission as a Greenville Native.

2. Property Insurance

Our portfolio reached critical mass in late 2022, with over 1,500 units of "market rate affordable housing" under ownership. We've leveraged our expanded portfolio to negotiate scaled savings with vendors and service providers. Our first focus was our ever-growing insurance premiums. As the number of insurance carriers in 1970s-1990s multifamily space has dwindled, insurance premiums have skyrocketed. Most owners of 1970s-1990s garden-style apartments are stuck absorbing these yield-eroding increases.

At the tail end of 2022, Affordable Upstate began the arduous process of aggregating its insurance policies into one Master Policy. The benefits of this have been multifaceted.

- Full Replacement Cost Coverage

- Umbrella Policy Coverage up 10X

- Over $100K in premium savings annually

This new Master Policy has much more robust coverage for far less cost, adding more than $2,000,000 of value to our portfolio (100K annual premium savings on a 5% cap rate)

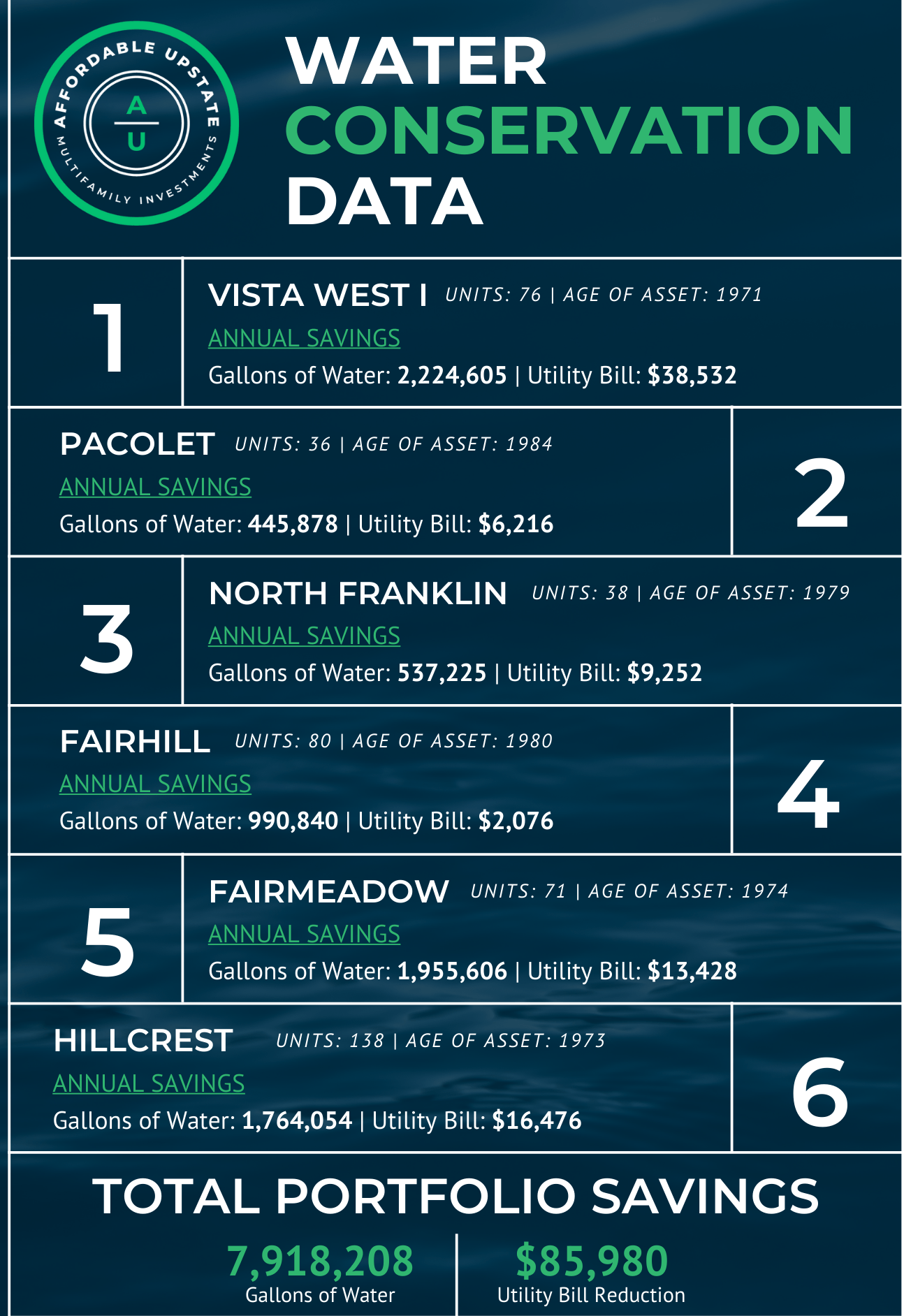

3. Utility Expenses

With approximately 35% of US employees working remotely from home, multifamily owners have experienced a considerable spike in utility usage at their properties (link.) Research shows that water usage, the work-from-home trend, is here to stay owners and operators of multifamily assets can either take increased utility usage on the chin, like the rest of the inflation rippling their P&L statements, or seek to impact these increases with programs like our AU Water Conservation Program. Since 2021 we have achieved massive property savings while conserving one of our most precious resources, water.

Continued Focus

As we continue negotiating with vendors and service providers, we will update you on the savings the portfolio realizes. This fight for scaled efficiency and discount on every expense line item of our financial statements is fully underway. We have been working on incorporating software and technology, like HappyCo, that creates a far less people-dependent business while drastically improving our access to information. We have also launched a property management company for a portion of our portfolio to reflect our core values in every interaction our tenant has with our assets.